Smithers anticipates major changes in corrugated packaging market

Published: 13 May 2024 | No comments yet

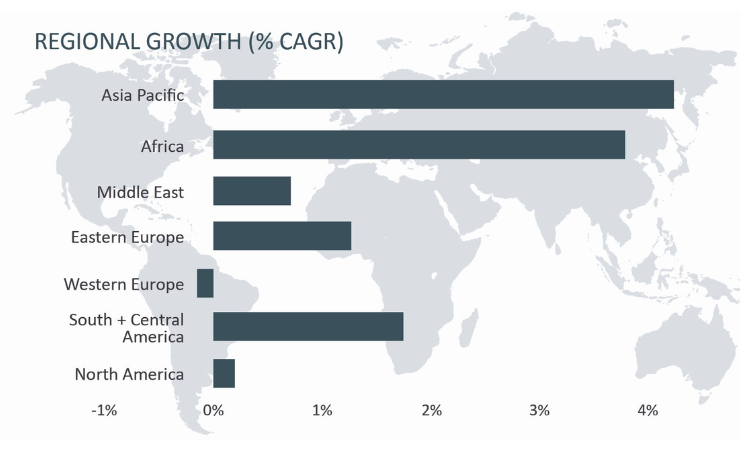

Regional growth CAGR for corrugated 2024-29

The latest Smithers report, ‘The Future of Corrugated Board Packaging to 2029’, highlights a series of challenges and shifts in market dynamics across the next five years for global containerboard and corrugated board demand.

Smithers analysis of capacity changes, pulp pricing, and end user demands shows that in 2023, global containerboard production was 183.4 million metric tons, a 4% decline since 2022. These were converted into around 165 million tons of corrugated board, a decrease of more than 7% since 2022; with value reaching $224.4 billion.

Forecast in the report shows a slight growth across 2024, with value increasing to $231.7 billion. This will be followed by a broader recovery in world demand at an average annual growth (AGR) of 2.5% by volume. This will see world corrugated volumes reach 190 million tons in 2029; value in the market will increase at an increase of 3.7% AGR to $277.6 billion, at constant prices.

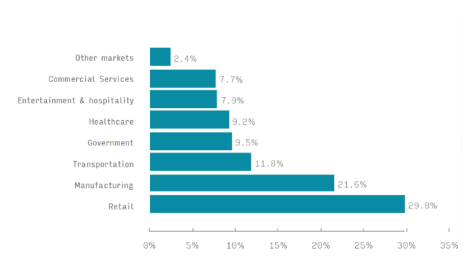

Across 2024-2029, demand for corrugated packaging will vary across the 13 different end-use sectors. The packaging and transportation of food products accounted for over 46% of the consumption of corrugated packaging material during 2023, a relatively constant level since 2016, is expected to change slightly to 47% by 2029. This will include a new surge for corrugated grades for processed foods.

Corrugated materials recyclability means they are increasingly being favoured by brand and legislators, not just in transit, but consumer-facing primary packs. This is pushing converters towards finer, premium flute grades that can compete with folding cartons in sectors such as cosmetics, confectionery, and consumer electronics.

Legislation such as the EU’s recently approved Packaging and Packaging Waste Regulation (PPWR) are opening other opportunities. The PPWR will ban certain single-use plastic formats by 2030, including smaller volume produce packs, and collation films for multipack beverages and food. Similar potential exists in food-service applications, is effective non-PFAS oil and grease resistance coatings can be integrated into existing corrugated lines.

Smithers also states that sales of retail-ready packaging (RRP) boxes are forecast to increase rapidly due to the increased popularity of budget grocery chains in developed markets, and growth of retail infrastructure across Asia. In some instance converters will benefit from the installation of a new generation of high throughput inkjet presses for corrugated board, producing higher quality customized RRP.

The rest of this content is restricted - login or subscribe free to access

Thank you for visiting our website. To access this content in full you'll need to login. It's completely free to subscribe, and in less than a minute you can continue reading. If you've already subscribed, great - just login.

Click here to Subscribe today Login here