Smithers’ latest report, ‘The Future of Thermal Printing to 2029’, has predicted that demand for inkjet thermal print equipment and consumables will increase sales across the next five years.

According to the report, combined sales of direct thermal (DT), thermal transfer (TT), and dye diffusion thermal transfer (D2T2) print technologies is projected to reach $42.55 billion (€39.12 billion) worldwide this year at end-user pricing. The company’s data highlights consumables (papers, labels, tickets and tags and ribbons photo media), accounting for 72.6% of the contemporary market, with hardware representing the remainder.

Smithers forecasts a steady increase, for the thermal inkjet market, at a compound annual growth rate (CAGR) of 3.1% for the next five years. This will push global market value, it said, to $49.59 billion (€45.60 billion) in 2029, at constant prices. With sales of printers increasing relative to supplies, supported by increased use of mobile and barcode thermal print equipment, explained the company.

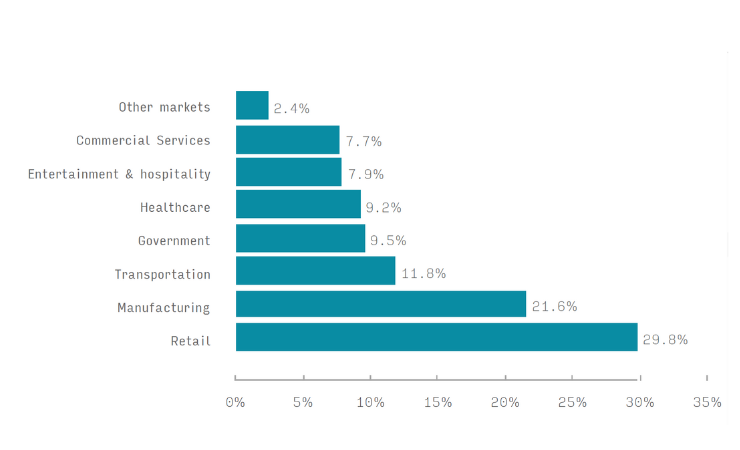

An area which will shape the evolution of the thermal print marketplace across the next five years are sales into retail environments which will be constrained, below its historic average, claimed the company. Subsequently, explained Smithers, printed receipts are expected to continue to decline as more transactions are handled electronically.

Additionally, continued the company, sales from conventional retail will remain diverted into ecommerce despite the switch being compensated for by the need for more thermally printed delivery labels. There are also gains be made in thermal receipts for ‘buy online pickup in store’ purchases, and combined POS receipts and labels in some sectors, notably, said Smithers, fast-food restaurants.

Smithers identified electronic ticketing as a threat to thermal printing in the ticket and travel sector; significant substitution has already taken place. For security documents, it continued, while there is a noticeable shift toward providing credentials electronically, the practical need for a physical back-up copy will limit any impact on sales volumes.

With a wider deployment of smart, automated inventory systems, creating a demand for manufacturers who can integrate conventional barcodes and 2D data matrix codes, RFID tags and readers, will become important to the fastest area of sales growth, manufacturing and healthcare, explained Smithers. Specialty thermal transfer overprint (TTO) devices used to print date and batch codes, continued Smithers, will see greater use as enhanced traceability requirements are imposed by law, principally on pharmaceutical shipments.

Due to regulatory changes, DT, said Smithers, will make further gains in healthcare across certain regions. The US Health Insurance Portability Accountability Act (HIPAA) has strict protocols on the potential fraudulent use of the reverse imprinted image on discarded ribbons, which are completely avoided when employing newer formulation label stocks, explained the company.

To conclude, Smithers identified thermal print OEM’s as being under pressure, across all end-uses, to deliver systems that have a lower environmental impact. Two noticeable trends for 2024-2029, continued Smithers, will be the wider use of linerless label formats and an accelerated changeover to phenol-free formulations for direct thermal systems.