Data modelling in the latest Smithers market report, ‘The Future of Inkjet Printing to 2029’, shows the inkjet printing market can grow with packaging, labels, books and graphics providing opportunities for the commercial inkjet market. The latest inkjet technologies will be on show when drupa 2024 opens on 28 May, with new sales set to accelerate industry transition to digital printing across multiple sectors.

According to the Smithers report, 2024 global sales from inkjet printing will reach $117.7 billion (€110.8 billion). Positive market conditions mean this is forecast is expected to expand, increasing by a compound annual growth rate (CAGR) of 6.6% by 2029. This will push overall market value to $162.1 billion (€151.6 billion) in 2029.

Across the same period, the volume of publications, graphics media, packaging and labels printed on inkjet will is expected to increase from 1.61 trillion A4 print equivalents to 2.29 trillion.

Smithers analysis dissects the business and technology developments that will fuel this inkjet’s expansion across 21 separate end-use segments and six press formats.

As the technology and new applications develop, print manufacturing workflows are increasingly being optimised for inkjet, making the process even more cost competitive. This is happening in book manufacture, where web presses deliver book blocks in a single pass, with flexible finishing allowing formats and paginations to be varied at full press speed.

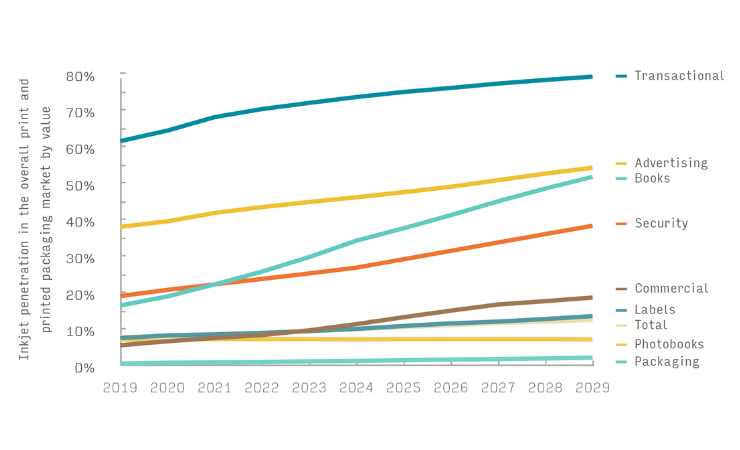

Multiple machine innovations are delivering finished print products, labels, and packaging more efficiently, and inkjet is steadily increasing its share across all print and printed packaging. The process already has good penetration into advertising print, particularly for displays and signage, but the report suggests share will diminish as much of this work moves into electronic channels. The fastest growth across 2024-2029 will be in packaging, labels, and books.

As this occurs, the benefits of faster turnarounds, print-on-demand sales, and higher quality mean inkjet’s market share by value will remain well ahead of its volume share in nearly all applications.

The report also highlights how higher performance equipment is coming on stream, with on-press speeds and printhead resolution both set to double over the next five years, the economic crossover for inkjet against analogue is rising, and will continue to increase. And as its quality improves, inkjet has become more viable in a broader range of premium print applications.