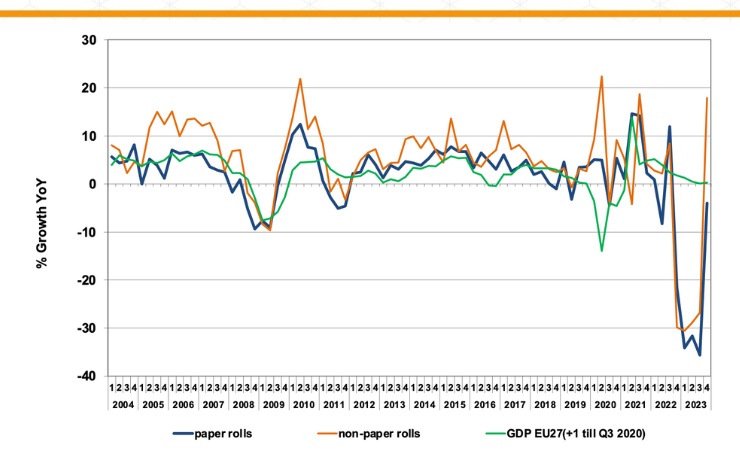

In the fourth quarter of 2023, labelstock demand in Europe increased by 2.1% compared to the same quarter in 2022, as discovered by Finat Radar, suggesting improved demand for labelstock in the industry that is set to continue in 2024.

This was the first increase after four quarters of double-digit decline that started in quarter four 2022, as the mix of subsequent post-Covid excess demand, raw materials shortages, stockpiling, supply chain disruptions, cost increases and economic decline hit hard on the label industry throughout the year 2023.

Compared to 2022, European consumption of self-adhesive label materials decreased by no less than 25.8%, the ‘sharpest’ decline in a single year recorded since Finat started the collection of statistics in 2003.

According to the latest Finat Radar published in February, the pattern of decline in labelstock consumption was similar across major end-use segments including food, beverages, and health and beauty care, all sectors that showed promising signs of recovery in the final quarter of 2023.

The decline of European labelstock demand was described as ‘more prominent’ and ‘prolonged’ than outside Europe and compared to other sectors in the labelling and packaging domain. One explanation is the stockpiling effect that was triggered by the prolonged paper industry strike in quarter one 2022, resulting in battle for raw materials (notably paper-based release liners and label facestock materials) and lead times of three to five months.

When raw materials availability returned to normal in the third quarter of 2022, the economic tide had turned, and label printers and label users had filled their warehouses for quarters to come. The downturn was compounded by the effect of increasing raw materials costs that, according to the Finat Radar, impacted the procurement of labels more than other packaging types.

According to the report, during the brand owner survey and interviews conducted, respondents highlighted the significant challenges they encountered due to evolving consumer demands. These challenges included a shift in consumer preference from branded products to private labels, alterations in seasonal demand patterns, and an oversupply of materials for certain stock-keeping units (SKUs) triggered by a drop in demand.

The decline in consumer confidence across the eurozone, as indicated by the European sentiment indicator, continues to reflect widespread concerns about inflation, energy costs, and the potential for economic downturn. However, the slightly brighter outlook from label suppliers and brand owners suggests optimism about the capacity for recovery and growth in the coming quarters.