The global market for inkjet digital printing will grow from $86.8 billion in 2022 to $128.9 billion in 2027, driven by digital’s position as ‘the most important print segment for innovation and market growth’.

This is according to a new study published by Smithers and authored by print industry consultant Sean Smyth, which has detailed how supply chain and print buying changes, combined with technology advances mean digital print – and inkjet in particular – is now the most important print segment for innovation and market growth.

In contrast to competing analogue processes, inkjet is forecast for strong future growth for a global market worth $86.8 billion in 2022. A compound annual growth rate (CAGR) of 8.2% for 2022-2027 will drive this value to $128.9 billion in 2027. While inkjet is well established in some lower-run applications, faster presses mean that it is becoming more cost competitive for longer print runs, even as many customers have revised their print buying strategies. This is reflected in the volume of inkjet prints, which will rise from one trillion A4 print equivalents to 1.7 trillion, equivalent to a 10% CAGR for 2022-2027.

The greatest expansion will come in packaging applications with installations of the latest dedicated presses for corrugated, cartonboard and flexible substrates. Inkjet is also broadening its market with double-digit growth forecast across the same period in commercial print, books, catalogues, magazines and directories. As the technology suite for inkjet improves it is increasingly pushing electrophotography (toner) print out of several core markets.

Technical developments that will shape and support the future evolution of inkjet printing will include:

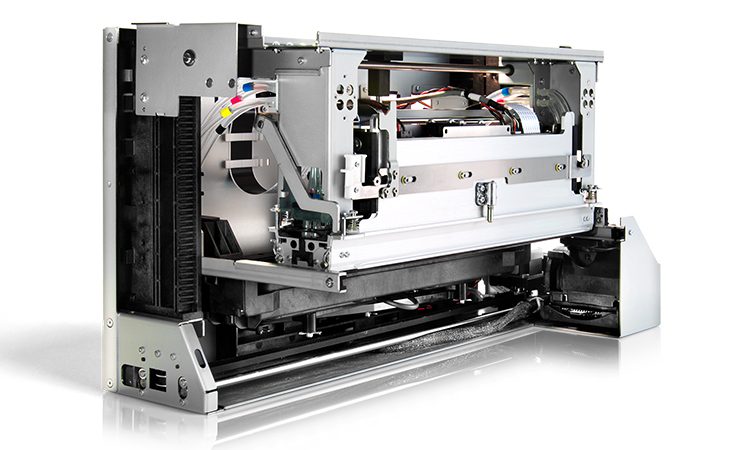

Press speeds and resolution, which will continue to increase, and over the five year study period, 200m/min presses and printheads offering 1200dpi will improve to a standard of 300m/min and resolution of 2400dpi;

Greater integration of robotics using smart monitoring to minimise downtime, and improving precision in direct-to-object print;

Productivity enhancements, including more large format sheet-fed machines able to produce up to 10,000 A4 impressions per hour;

Falling ink prices, supported by an improved range of UV-curable and water-based inks, and the steady evolution of more specialist whites, metallic effects, fluorescents, varnishes and security inks;

The arrival of additional embellishment and tactile finishes, which will allow further diversification into segments like home décor, transport, garments and other textile applications; and

Price competitiveness versus analogue on all but the longest commissions.

The market is also benefitting from technical developments that are enabling inkjet to print on standard paperboard substrates, with a quality that is already approaching that of offset litho at the top of the market.

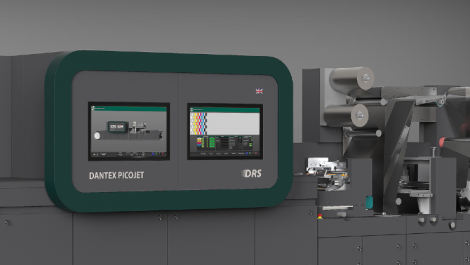

Through to 2027, inkjet printrooms will benefit from systems that give real-time comparison to digital masters to deliver defect-free print runs; and better integration with more options in finishing

The study also found that as a digital-native technology, inkjet is best placed to integrate with online sales and maintenance – making it a strong fit for post-Covid boom segments, such as e-commerce packaging. It is also more accessible to new users, helping address the skills shortage that is now afflicting many printrooms.

Mr Smyth, who authored ‘The Future of Inkjet Printing to 2027’ and serves as technical editor for Whitmar Publications’ titles, will provide further details and fidnings from the report in the July/August 2022 issue of Digital Labels & Packaging; register here to receive the magazine