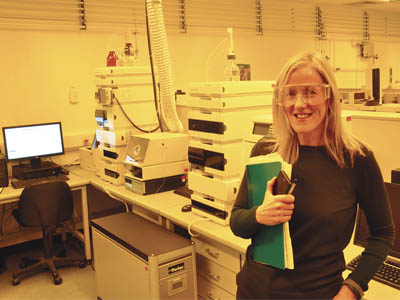

Dr Carole Noutary, technical manager R&D at FSIS, with the Q-TOF mass spectrometer

Ink has to perform well not only in the printer on a range of substrates, but all the way through subsequent converting processes, in filling and distribution, and in the consumer’s hands, then be recyclable. By Sean Smyth.

In packaging a key consideration in the choice of the printing method is the performance of the ink and coatings. Food, tobacco and pharmaceutical applications account for the majority of the packaging market and ensuring there is no possible contamination has been a drag on the adoption of digital technology. Changing print methods means converters must conduct comprehensive testing to guarantee the performance of the new packs.

There has been steady progress in the use of toner technology with HP Indigo and Xeikon continuing to build their market presence in labels, cartons and increasingly flexible packaging. Using toner technology means there are fewer potential issues with food contact, provided suitable care and barriers are present between the print and the product in the pack.

Xeikon claims its toners are completely food safe – as part of a tour of the toner plant in Heultje, the guide actually ate some of toner – and it has a couple of users who print 21 gsm paper labels that are stuck directly onto cheeses. Filip Weymans, director of marketing, also highlights a number of recent press installations printing paper coffee cups, as a niche the food safe toners can exploit.

HP Indigo provides a wealth of information on its toner systems in labels and packaging, and with the suitable barriers Indigo is approved for many food packaging applications.

Inkjet developments

It is inkjet where there are significant ink developments. At drupa 2016, Kao Collins showed its first electron beam (EB) curing ink. The first applications are aimed at adding variability to flexo presses, but it is also aimed as an alternative to UV curing. The advantage is the ink is lower cost than the standard UV formulations because there is no photoinitiator, which is typically the most expensive part of the ink vehicle. While the EB drying unit is a much higher cost than LED or mercury vapour lamps, there are fewer potential components that could migrate, creating a possible contamination in food or pharma applications.

Sun Chemical has experience in most ink markets; it is the biggest inkmaker in the world and also makes pigments and resins. SunJet is the division making inkjet inks, with headquarters and technical development centre in Midsomer Norton, where it also makes screen inks and circuit products. SunJet makes OEM inks for machine manufacturers, not selling to users under its own brand. It is the leader in producing low migration formulations for food and pharmaceuticals, and the company utilises this expertise in inkjet, with the Amphora brand for packaging and EtiJet for labels.

Inkjet drop analysis equipment at SunJet laboratories

Rick Hulme is the global sales and product manager for SunJet. He is excited by the opportunities for the new AquaCure range of inks, ‘SunJet remains focused on delivering market defining inkjet chemistry to labels and packaging. This started in 2008, with low migration UV inks in 2013 and most recently AquaCure – ink formulated to cure with UV, UV LED or EB. The EB technology is unique because it can be pinned, boosting image quality and allowing single pass inkjet to be utilised. In the case of 100% solids pinning is with LED lamps prior to final EB cure, while AquaCure manages image quality with thermal pinning followed by full thermal cure to remove the remaining water before EB curing.

‘AquaCure is exciting because it delivers a similar appearance to flexo or offset. Other benefits include low film weight, low odour and low migration properties as well as reduced hazard labelling and an extended colour gamut. All are achieved whilst being more sustainable than UV and solvent chemistries.’

AquaCure is a functional aqueous formulation that can contain up to 80% water, with pigmentation and vehicle components. The print is initially dried with media heating and hot air to remove water, thereby pinning the ink, followed by UV or EB curing. Using water provides several advantages, not least a lower ingredient cost, while allowing low viscosity formulations that perform well in the latest generation of fast, high quality printheads. What is more significant is the final print that has a much lower film thickness compared with 100% solid UV inkjet, which will provide a boost to the acceptance of inkjet in labels and packaging. The ink is suitable for printing onto a variety of substrates without any need for priming, and the low film profile – similar to flexo or gravure – will open up flexible packaging applications.

SunJet is very aware of the food safety requirements, moving experts in from the analogue business to make sure the inkjet conforms to the legislation across the world.

Designing inks

Agfa also has much experience in producing low migration UV curing ink, particularly for the growing direct to shape market where it supplies inks suitable for printing onto plastic cups. These inks use high molecular weight components that are inherently low migration, including polymerisable Norrish Type II photoinitiators (the photochemical homolysis of aldehydes and ketones into two free radical intermediates – which I am sure you remember).

Agfa sells inkjet inks under the Altamira brand for packaging and labels, with the Altamira Pack LMX ink targeted at migration-sensitive applications including direct print on food containers and blister foils. The company stressed that food-safe packaging printing results from the correct combination of substrate, low migration ink with the print system and conditions (especially curing), type of food, and processing conditions after printing. This food or pharma safety needs to be proven by migration testing.

Fujifilm Speciality Ink Systems (FSIS) is a leading producer of inkjet inks for graphics, packaging and industrial products based at Broadstairs, in Kent. It has a focus on supplying robust, reliable products tailored to a range of specific applications. Packaging should not affect any food contents and this means migration levels of volatile ink and coating components at levels of less than 10 parts per billion. As analytical chemistry develops these limits will fall. FSIS recently spent several hundred thousand pounds to acquire a Q-TOF (Quadropole Time Of Flight) mass spectrometer to identify minute quantities of trace contaminants, which is an important capability when designing inks for food contact applications. FSIS takes ink development very seriously, continually improving its manufacturing methods and testing processes to ensure full safety for customers.

In Japan, Fujifilm is using a novel two-pack UV curing ink on the 52 cm wide MJP20W flexible packaging press. This uses a base primer that is a component of the ink vehicle, the jetted ink includes pigment, monomer and initiator printed onto the primer. This is cured under cool LED, allowing thin heat-sensitive films to be printed, with the system using nitrogen inertion to minimise odour and taint to ensure complete through curing. The two-pack ink system reduces the film build weight, which is widely seen as a potential problem when printing onto thin films. Fujifilm is continuing to develop new UV LED inkjet technologies suitable for the EMEA and American markets.

More joining

Some companies believe that water-based inks (although they may contain solvents and organic humectants) will open up packaging markets. Heidelberg, Landa and KBA-Xerox are promoting their water-based inks for the sheetfed carton presses coming to market. In corrugated, HP, Screen/BHP, SunJet and Bobst are using water-based inks, but EFI and Barberán are working with UV curing, while Durst uses a hybrid UV/water system in its Water Ink.

As the market matures more players are joining in. Siegwerk started to develop inks for labels (UV curing) and packaging (water-based) in 2013, opening an inkjet facility in Annemasse, France, last year. Over 90% of Siegwerk ink is for packaging and labels, and it is focused on the sector and understands converter and brand-owner requirements. Matthieu Carni, business development manager, said, ‘The opening of Siegwerk’s inkjet centre created incredible momentum with our partners and customers and we are excited to be supporting them in this rapidly changing environment. Now that inkjet is making its way into labels and packaging, we see a growing demand for application-driven inkjet ink systems. The market pull for customised solutions fits excellently with our value proposition based on application expertise, product safety and ink performance.’

Nazdar supplies UV and UV LED inkjet inks for a variety of equipment including narrow web label presses. It competes with equipment suppliers to provide alternatives to the manufacturers ink with a lot of business in wide format.

In the preparation of this article I visited several inkjet ink manufacturers and spoke to many others. Allsee packaging as a major, growing market opportunity over the next few years and are spending considerable sums in development, manufacturing and distribution.