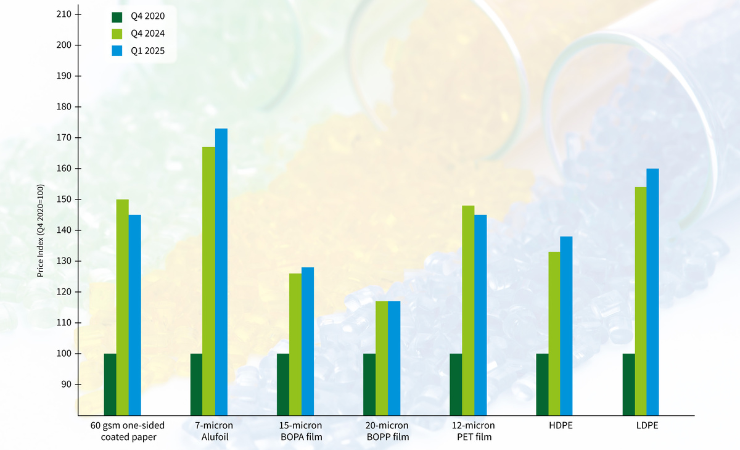

Prices for flexible packaging materials in Europe showed mixed movement in the first quarter of 2025, continuing the trend seen at the end of 2024, according to data from Flexible Packaging Europe (FPE). The data collected also revealed that polyethylene recorded the largest price increases among major substrates, while some paper and plastic films saw declines.

FPE said high-density polyethylene (HDPE) and low-density polyethylene (LDPE) rose by 3% and 4% respectively compared to the previous quarter, reaching their highest levels since early 2023. In contrast, prices for 60 gsm one-side coated paper and 12-micron PET film fell by 3% and 2% respectively, stated the company.

Aluminium foil (seven micron) saw a 3% price increase, continuing its upward trend, while BOPA film (15-micron) rose by 2%. BOPP film (20-micron) prices remained unchanged, the company added.

Santiago Castro, senior research analyst at Wood Mackenzie, said: “The prices paid in Europe for flexible packaging materials varied in Q1 2025 were driven by price fluctuations in raw materials, logistics issues and factors in overseas markets. The BOPET price reductions were largely due to declines in raw materials. While the reduction in paper prices is accounted for by under-utilised mill capacity and lower-than-expected energy prices. Higher raw material prices account for Alufoil and BOPA increases. BOPP prices remained relatively unchanged because of continued weak demand and over-supply.”

He added: “Overall demand for flexible packaging remained weak in Q1, driven by reduced consumer spending and a shift towards leaner inventory management. Prices are expected to increase for all substrates, largely due to increased raw materials costs, next quarter.”

Kaushik Mitra, chemical market analyst, attributed the polyethylene price increases to both cost and supply chain pressures. “The first quarter sharp increase in PE prices is due to raw material cost inflation and tighter inventory balances due to lower imports,” he said. “The imports figures were affected by low order booking and supply chain bottlenecks. PE demand is still lacklustre due to macroeconomic factors and continuing market uncertainty, although some sectors like construction, consumer products and packaging are showing signs of stability.

Guido Aufdenkamp of FPE added: “While raw material supply and logistics issues continue to weigh on flexible packaging markets, there are signs that after the weak 2023 and recovery in 2024 the overall demand continues to increase slightly. While the geopolitical and trade developments cause continued uncertainties in both supply and demand, the industry is cautiously optimistic for the rest of 2025.”